[ad_1]

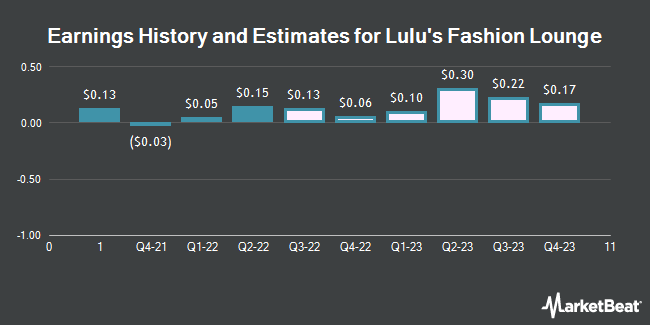

Lulu’s Fashion Lounge Holdings, Inc. (NASDAQ:LVLU – Get Rating) – Equities research analysts at KeyCorp lifted their FY2022 earnings per share estimates for shares of Lulu’s Fashion Lounge in a report issued on Tuesday, August 16th. KeyCorp analyst N. Zatzkin now forecasts that the company will post earnings of $0.29 per share for the year, up from their previous estimate of $0.17. KeyCorp currently has a “Overweight” rating and a $10.00 price target on the stock. The consensus estimate for Lulu’s Fashion Lounge’s current full-year earnings is $0.32 per share. KeyCorp also issued estimates for Lulu’s Fashion Lounge’s Q4 2022 earnings at $0.00 EPS and FY2023 earnings at $0.43 EPS.

Lulu’s Fashion Lounge (NASDAQ:LVLU – Get Rating) last issued its quarterly earnings data on Tuesday, August 16th. The company reported $0.15 earnings per share (EPS) for the quarter, missing the consensus estimate of $0.22 by ($0.07). Lulu’s Fashion Lounge had a net margin of 0.70% and a return on equity of 12,267.49%.

A number of other equities analysts also recently weighed in on LVLU. Piper Sandler reduced their price target on Lulu’s Fashion Lounge from $14.00 to $11.00 and set a “neutral” rating for the company in a research report on Wednesday. Cowen reduced their price target on Lulu’s Fashion Lounge from $22.00 to $12.00 in a research report on Friday, July 29th. Telsey Advisory Group reduced their price target on Lulu’s Fashion Lounge from $18.00 to $12.00 and set an “outperform” rating for the company in a research report on Friday, July 29th. Robert W. Baird reduced their price target on Lulu’s Fashion Lounge from $17.00 to $10.00 and set an “outperform” rating for the company in a research report on Friday, July 29th. Finally, Bank of America cut Lulu’s Fashion Lounge from a “buy” rating to a “neutral” rating and upped their price objective for the stock from $14.00 to $21.00 in a research note on Friday, June 10th. Two analysts have rated the stock with a hold rating and six have given a buy rating to the company’s stock. According to data from MarketBeat, the stock has a consensus rating of “Moderate Buy” and an average target price of $14.00.

Lulu’s Fashion Lounge Trading Down 3.2 %

NASDAQ:LVLU opened at $6.90 on Friday. Lulu’s Fashion Lounge has a twelve month low of $5.10 and a twelve month high of $21.29. The company has a quick ratio of 0.48, a current ratio of 1.11 and a debt-to-equity ratio of 0.24. The business has a 50 day moving average price of $9.50 and a two-hundred day moving average price of $9.98. The company has a market cap of $267.95 million and a P/E ratio of -1.58.

Hedge Funds Weigh In On Lulu’s Fashion Lounge

Hedge funds and other institutional investors have recently made changes to their positions in the company. Strs Ohio lifted its holdings in Lulu’s Fashion Lounge by 5.9% during the 2nd quarter. Strs Ohio now owns 23,200 shares of the company’s stock valued at $251,000 after purchasing an additional 1,300 shares during the last quarter. Bank of America Corp DE lifted its holdings in Lulu’s Fashion Lounge by 27.5% during the 1st quarter. Bank of America Corp DE now owns 6,304 shares of the company’s stock valued at $42,000 after purchasing an additional 1,358 shares during the last quarter. New York State Common Retirement Fund acquired a new stake in Lulu’s Fashion Lounge during the 4th quarter valued at $25,000. Northern Trust Corp lifted its holdings in Lulu’s Fashion Lounge by 5.5% during the 2nd quarter. Northern Trust Corp now owns 48,642 shares of the company’s stock valued at $528,000 after purchasing an additional 2,532 shares during the last quarter. Finally, Quantbot Technologies LP acquired a new stake in Lulu’s Fashion Lounge during the 2nd quarter valued at $39,000. 51.34% of the stock is owned by institutional investors.

About Lulu’s Fashion Lounge

(Get Rating)

Lulu’s Fashion Lounge Holdings, Inc operates as an online retailer of women’s clothing, shoes, and accessories. The company offers dresses, tops, bottoms, bridal wear, intimates, swimwear, footwear, and accessories under the Lulus brand. It sells its products through owned media, which primarily consists of its website, mobile app, social media platforms, email, and SMS; and earned and paid media, as well as social media platforms.

Recommended Stories

Receive News & Ratings for Lulu’s Fashion Lounge Daily – Enter your email address below to receive a concise daily summary of the latest news and analysts’ ratings for Lulu’s Fashion Lounge and related companies with MarketBeat.com’s FREE daily email newsletter.

[ad_2]

Source link