[ad_1]

Svetlana Borisova/iStock via Getty Images

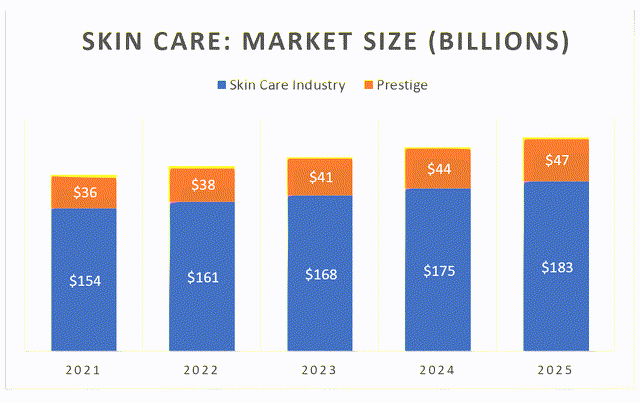

Nanophase Technologies Corporation (OTC:NANX) is a virtually unknown firm that has developed unique, much in-demand formulations for use in the personal skin care and other industries. While not as exciting as developing a new EV, demand for the company’s IP-protected products has significantly outstripped production capabilities. The company is partway through an expansion, both in equipment as well as in physical space, to meet current and future demand. Currently trading on the NASDAQ OTCBB marketplace, the company qualifies for, and is eventually expected to transition to an AMEX or full NASDAQ listing in 2023.

It is my belief that there are multiple potential catalysts that can propel the stock price materially higher over the next six-to-twelve months.

Company Website

Catalysts

In the body of the article, I will discuss several of the catalysts that can positively impact the stock price.

- Expand production capacity to enable timely fulfillment of orders

- Improve operational efficiency and return gross margins to 2021 levels (and improve)

- List on AMEX or NASDAQ (full, not OTCBB)

- Enhance contracting; implement price increases reflecting product value, scarcity, and uniqueness

- Streamline supply chain to optimize product costs and inventory levels

What is Nanophase?

You can read the company’s 10-K filing, where it describes itself as a ‘health-oriented, science driven company’ or my original article, Nanophase: Real Company, Real Growth, Real IP, Real Value to learn more of the specifics. Nanophase’s growth vehicle is the Solésence brand, which produces ingredients for sale to skin care and beauty product marketers, most often in the ‘prestige’ market segment. Nanophase’s products are ingredients, not end-products, which allows sales to a wide variety of industry players. The unique product offers superior aesthetics and performance, focusing on unique zinc oxide formulations. Customers can purchase either white-label or custom-formulated product. Additionally, proprietary Active Pharmaceutical Ingredients (“APIs”) are also sold for use in sunscreens and daily care products. Product demand has grown both from the underlying performance of the products and recent pronouncements by the FDA deeming zinc oxide, the base of virtually all of the company’s products, as one of only two ingredients deemed safe by the FDA. Initially only available at specialty retailers, the company’s ingredients can now be widely found in products sold at most retailers.

Recognized for Innovation

Earlier this month, the company won the prestigious Cosmopack Award for formulation, which “formally recognize(s) the absolute best in beauty products…”. Additionally, almost half (five of 11) the products identified as “The Most Innovative Sunscreens You Can Buy” were developed and manufactured by the company.

The market has noticed, and values Nanophase’s product and development capabilities, with Solésence product sales increasing 170% in 2021 and 58% in the most recent (second) quarter. Solésence sales comprised 63% of overall Nanophase sales in Q2 2022, and along with the Personal Care Ingredients segment, 29% of sales (up 86% compared to the prior year), are the fastest growing and most important segments in the company.

While Solésence is an ingredient, not a brand, its products are featured in leading beauty retailers such as Sephora, Ulta (ULTA), Credo and Blue Mercury, and, as consumer demand for mineral-based solutions increases, the product is being given space at high-volume retailers like Target (TGT) and Walmart (WMT).

During a recent conference call, COO Kevin Cureton noted that the growth rate for the sun care market is 51%, and that the company is “leading innovation in this sector”.

Grand View Research

The FDA Approves of Nanophase (products)… and Notes Risks of Traditional Sun Protection Solutions

The FDA recently published a ‘deemed final order’ for over-the-counter sunscreens. The order identified safe and unsafe ingredients in products claiming SPF protection. Zinc oxide, Nanophase’s skin-care products base, along with titanium dioxide, are deemed safe. Conversely, a majority of products sold today use ingredients not deemed ‘Generally Recognized as Safe and Effective’ (GRASE). As this information filters down to consumers, sales are migrating to those products which contain ‘safe ingredients’ – products that use Nanophase’s formulations.

BASF: Longtime customer, Largest customer, Not growth customer

Prior to the development of its proprietary Solésence-branded skin care products, the bulk of Nanophase’s sales were derived from ‘Personal Care Ingredients.’ These products are almost exclusively sold to BASF (OTCQX:BASFY). Though less exciting, from a shareholder perspective, sales in this segment increased 86% in Q2 2022 and comprised 29% of the quarter’s sales.

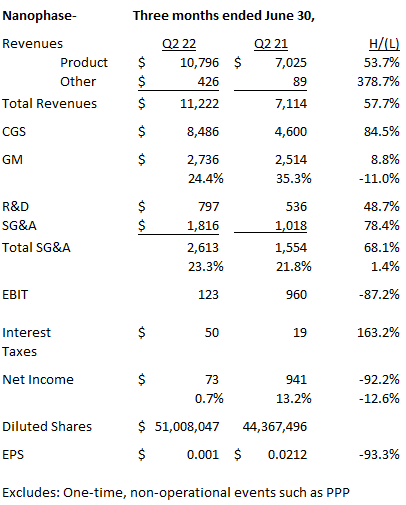

Second Quarter 2022 Results Were Good… And Not So Good

For the three months ended June 30, 2022, Nanophase killed it on sales, growing the top line by 54% compared to the prior year (and 38% sequentially) to $11.2 million ($19.4 million for the six-month period). Unfortunately, the company had problems meeting demand, and gross margin, while increasing in dollars $0.2 million, fell in percent by 11.0%, to 24.4% (peak margin, before demand started to overwhelm in-place production capacity, was 43.4% in Q3 2020). The Company cited heavy use of overtime, difficulty in hiring labor and the inability to complete planned engineering and capital projects due to “the near complete absorption of our current engineering resources in addressing current demand”, in addition to cost increases.

SEC filings and author analysis

Additionally, Nanophase invested heavily in the future, increasing SG&A by a whopping 68.1% to $2.6 million. Sales, marketing, operations, and engineering were all enhanced. While this was a heavy lift, the company expects to see margin benefits over the next several quarters, as it looks to further build on its sales and product successes. The increase looks like a lot, and it is, but the company has strong rationales for all of the hires. I am giving them the benefit of the doubt that: 1) the year-end margin situation will be much improved; and 2) the order book will be robust (I project sales increasing by at least 45%, to $65 million in 2023).

From a glass-half-full perspective, the company has continued to successfully grow sales – unarguably the hardest and most challenging activity for any company; with backlog exceeding $18 million at quarter end. Capacity and production adjustments to improve margins are, obviously, a focus area for the company. Simply returning to the levels of last year would have added $0.024/share to the quarter’s results. Returning to peak margin would have added $0.042/share. Operational improvements are actively being addressed by COO Kevin Cureton, and were given ample discussion during the second quarter conference call; investors should start to see improvement in Q3, and material improvement by Q4.

Consolidating Warehouses Will Help Productivity

For several quarters, Nanophase has been struggling to meet demand, and has sacrificed margins due to staffing shortages and the logistical inefficiencies of operating from multiple facilities. To ensure the ability to meet ever-growing demand while returning margins to target (40%+) levels, the company has been/is investing in new facilities as well as additional logistics/production personnel. In December 2021, the company announced the lease of 260,000ft in production and warehouse space; this leased property more than triples the current manufacturing footprint, which has been spread over three plants. In Q1, Nanophase hired around thirty people, mainly for production, but also for sales, marketing and customer service. In Q2, Nanophase consolidated from multiple small-and-medium sized warehouses to one large facility, at a cost of the availability of management and engineering resources as well as the productivity declines reflected in the disappointing gross margin. Positively, these transition issues are behind the company, already, Cureton noted, “we are seeing the expected reduction labor costs as a result of increasing output per labor hour.”

Building Bench (and Front Line) Strength

During the most recent conference call, the company discussed the hiring of a director of manufacturing, an impending director of supply chain add, as well as additional sales, business development, and marketing leaders.

Adequate Credit Facilities to Support Growth

In the past, Nanophase had to throttle back growth due to limited cash availability. In the first quarter (January 2022), the company’s access to capital was dramatically expanded under a new A/R Revolver Facility, which increased the borrowing maximum by to $8 million, from $6 million. At the same time, the company secured a new $4 million Inventory Facility. These facilities provide much needed liquidity to the company and carry an attractive rate of prime plus 0.75%.

Looking ahead, CEO Jess Jankowski noted that working capital should drop as the company expects supply chain issues to ease resulting in reduced inventory, and to improve on collection velocity.

Leadership Approach and Strategy

Jess Jankowski, CEO, and, Kevin Cureton, COO, comprise Nanophase’s front-line leadership. As demonstrated by the influx of sales and marketing talent, they are expecting strong sales growth for the foreseeable future. Their comments during the most recent conference call suggest they are highly cognizant of the need to improve margins while continuing to attract new business.

A New Listing

The company’s OTC listing precludes many institutions from owning the stock. With the hiring of a new Controller, CEO Jankowski believes Nanophase can begin to pursue a traditional listing. He has suggested the company is considering an AMEX listing (AMEX is owned by the NYSE) along with a full NASDAQ listing. Either choice would provide a much larger stage for the company to be viewed.

Perhaps given the current suboptimal performance, a main stage debut in 2023 will be well timed. An upgrade from the current OTC listing should provide visibility, trading volume, and ultimately a non-discounted stock price.

Catalysts

As I outlined in the beginning, there are at least five material catalysts that can drive the stock forward. None are a surprise. All have the potential to drive material incremental value in the company’s stock price. All should be highly visible within one year (or less).

1. Expand production capacity to enable timely fulfillment of orders

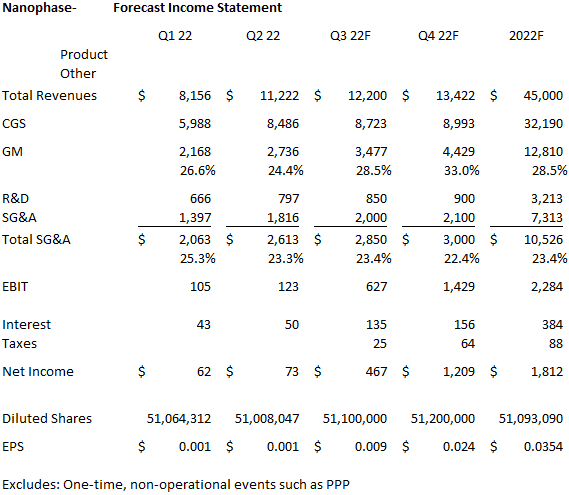

As discussed, Nanophase has invested in equipment and physical capacity. Management is fully engaged to expand sales and gross margin. The sales part of the business, traditionally the hard part, has been easy as of late, with demand vastly outstripping supply capabilities. In June of this year, sales hit $4.9 million; management notes that this level can be “representative of future run rates.” These actions and comments suggest the company can continue to increase sales and backlog while diversifying its customer base (accepting new customers who do not find current order-to-delivery delays acceptable). Based on the combination of peak throughput, management comments regarding backlog and 2023 orders, it’s reasonable to pencil in sales of $45 million and $65 million for 2022 and 2023, respectively.

2. Return operational efficiency to 2021 levels (and improve)

With the warehouse consolidation just completed, and engineers beginning to focus on production efficiencies, the deployment of equipment, and an impending new Director of Supply Chain in the works, it is logical to expect both product throughput and efficiencies to improve for each of the next several quarters. Gross margins in the most recent quarter were 24.4%, compared to 35.3% in the prior year. Peak margins of 43.4% were achieved in Q3 2020. I believe margins can hit 33% by Q4, and for the full year 2023, a 37% gross margin is attainable.

3. List on AMEX or NASDAQ (full, not OTCBB)

As discussed, the lack of a “major” listing precludes many investors, including funds, from even considering the stock. The current listing negatively impacts company credibility, trading liquidity, and most importantly price. During 2023, I expect Nanophase to be listed on a major exchange. The announcement, and subsequent listing would likely both have a material positive impact on the stock price.

4. Enhance contracting; implement price increases reflecting product value, scarcity, and uniqueness

Nanophase is still in the awkward period of realizing it is no longer the gawky adolescent but the attractive adult. In other words, it can use the desirability of the company’s products to negotiate better prices, exclusive supply/fulfillment contracts, branding/logo presence, etc. The ability to extract price increases, combined with operating efficiencies should enable the company to achieve target margins.

5. Enhance supply chain to optimize product costs and inventory levels

The company admits it overbought in recent quarters to ensure product fulfillment capabilities. It also recognizes the lack of ability to optimize purchasing and inventory control have created large cost issues. The company is close to bringing on talent to alleviate problems in these areas. Success will support increased sales (catalyst 1), higher margins (catalyst 2), faster reporting (catalyst 3), and more efficient use of the company’s credit facilities (catalyst 1).

Profitability Outlook and Valuation

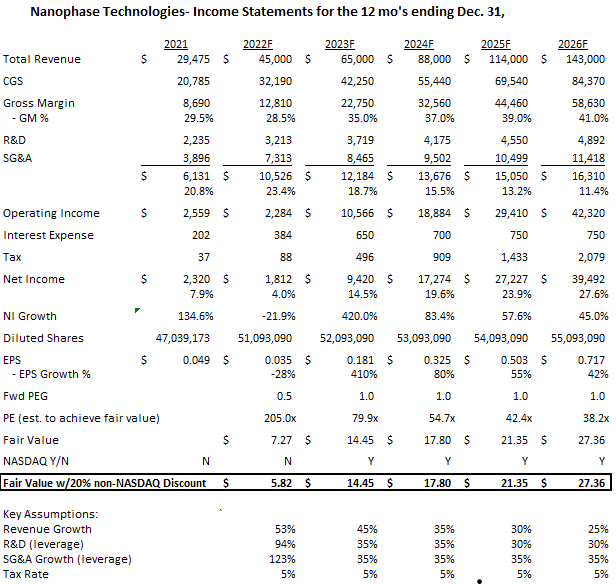

The sales outlook for the second half of 2022 and beyond, is very promising. The margin outlook for 2023 and beyond is really, really exciting (it will be an earnings force multiplier). My current forecast for 2022 EPS is $0.035/share, growing to $0.181/share in 2023, as robust sales growth continues and margins expand.

SEC filings and author analysis

Looking to 2023, we can expect 45% sales growth, margins approximating 37%, and a much lower growth in SG&A spending. I project decelerating, but still robust, sales growth for 2024-26, and controlled SG&A growth.

SEC filings and author analysis

Valuing Nanophase, a small, rapidly growing company is a challenge. The company suffers from lack of investor awareness. Any participation in industry events would help increase awareness, and therefore increase the ‘demand’ side of investor interest (as well as enhance liquidity, a current investor challenge). An upgrade to a major exchange, as discussed previously, will also provide the opportunity for significantly increased institutional ownership. The lack of a NASDAQ listing discounts, in my model, fair value by 20% (25% value increase upon listing).

Price Target

Target price by the end of 2023 is $14+/share. If the company is not sold by the end of the forecast period, I think a value in the $25-$30 range is not unreasonable to contemplate.

Due Diligence

As always, do your own due diligence, research, and analysis. Be an independent thinker and create your own fact-based investment thesis.

[ad_2]

Source link