[ad_1]

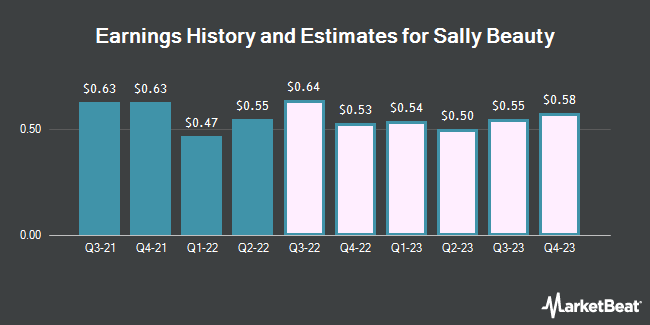

Sally Beauty Holdings, Inc. (NYSE:SBH – Get Rating) – Equities researchers at Jefferies Financial Group reduced their FY2022 earnings estimates for shares of Sally Beauty in a research note issued on Thursday, August 4th. Jefferies Financial Group analyst S. Wissink now expects that the specialty retailer will post earnings of $2.03 per share for the year, down from their previous estimate of $2.23. The consensus estimate for Sally Beauty’s current full-year earnings is $2.20 per share. Jefferies Financial Group also issued estimates for Sally Beauty’s Q1 2023 earnings at $0.54 EPS, Q2 2023 earnings at $0.50 EPS, Q3 2023 earnings at $0.55 EPS and Q4 2023 earnings at $0.58 EPS.

SBH has been the subject of several other reports. Raymond James lowered shares of Sally Beauty from a “market perform” rating to an “underperform” rating in a report on Wednesday, June 29th. StockNews.com lowered shares of Sally Beauty from a “buy” rating to a “hold” rating in a report on Friday. Morgan Stanley cut their price target on shares of Sally Beauty from $12.00 to $11.00 and set an “underweight” rating for the company in a report on Monday. Cowen cut their price target on shares of Sally Beauty from $30.00 to $20.00 in a report on Friday, May 6th. Finally, Oppenheimer lowered shares of Sally Beauty from an “outperform” rating to a “market perform” rating in a report on Thursday, May 5th. Two equities research analysts have rated the stock with a sell rating and three have assigned a hold rating to the company. Based on data from MarketBeat.com, the company presently has an average rating of “Hold” and an average price target of $17.50.

Sally Beauty Price Performance

NYSE:SBH opened at $14.36 on Monday. The company has a debt-to-equity ratio of 3.66, a current ratio of 1.60 and a quick ratio of 0.29. The firm has a market cap of $1.54 billion, a price-to-earnings ratio of 7.04 and a beta of 1.38. The company has a 50 day moving average price of $13.17 and a 200-day moving average price of $15.15. Sally Beauty has a 1-year low of $11.28 and a 1-year high of $21.86.

Sally Beauty (NYSE:SBH – Get Rating) last posted its earnings results on Thursday, August 4th. The specialty retailer reported $0.55 earnings per share for the quarter, missing the consensus estimate of $0.59 by ($0.04). The firm had revenue of $961.47 million for the quarter, compared to analysts’ expectations of $950.97 million. Sally Beauty had a net margin of 5.99% and a return on equity of 90.85%. Sally Beauty’s revenue for the quarter was down 6.0% compared to the same quarter last year. During the same period last year, the firm earned $0.68 earnings per share.

Institutional Investors Weigh In On Sally Beauty

A number of large investors have recently modified their holdings of the business. Champlain Investment Partners LLC grew its holdings in shares of Sally Beauty by 0.3% during the fourth quarter. Champlain Investment Partners LLC now owns 4,547,235 shares of the specialty retailer’s stock worth $83,942,000 after buying an additional 12,290 shares in the last quarter. Fisher Asset Management LLC boosted its position in shares of Sally Beauty by 97.2% during the 4th quarter. Fisher Asset Management LLC now owns 3,629,631 shares of the specialty retailer’s stock valued at $67,003,000 after acquiring an additional 1,789,399 shares during the last quarter. Principal Financial Group Inc. boosted its position in shares of Sally Beauty by 6.7% during the 1st quarter. Principal Financial Group Inc. now owns 3,031,516 shares of the specialty retailer’s stock valued at $47,383,000 after acquiring an additional 189,583 shares during the last quarter. Polaris Capital Management LLC acquired a new position in shares of Sally Beauty during the 1st quarter valued at about $45,611,000. Finally, Dimensional Fund Advisors LP boosted its position in shares of Sally Beauty by 0.6% during the 1st quarter. Dimensional Fund Advisors LP now owns 2,544,961 shares of the specialty retailer’s stock valued at $39,779,000 after acquiring an additional 14,113 shares during the last quarter.

About Sally Beauty

(Get Rating)

Sally Beauty Holdings, Inc operates as a specialty retailer and distributor of professional beauty supplies. The company operates through two segments, Sally Beauty Supply and Beauty Systems Group. The Sally Beauty Supply segment offers beauty products, including hair color and care products, skin and nail care products, styling tools, and other beauty products for retail customers, salons, and salon professionals.

Featured Articles

Receive News & Ratings for Sally Beauty Daily – Enter your email address below to receive a concise daily summary of the latest news and analysts’ ratings for Sally Beauty and related companies with MarketBeat.com’s FREE daily email newsletter.

[ad_2]

Source link