[ad_1]

SG Americas Securities LLC boosted its holdings in The Beauty Health Company (NASDAQ:SKIN – Get Rating) by 589.7% in the 1st quarter, HoldingsChannel reports. The firm owned 36,290 shares of the company’s stock after purchasing an additional 31,028 shares during the quarter. SG Americas Securities LLC’s holdings in Beauty Health were worth $613,000 at the end of the most recent reporting period.

SG Americas Securities LLC boosted its holdings in The Beauty Health Company (NASDAQ:SKIN – Get Rating) by 589.7% in the 1st quarter, HoldingsChannel reports. The firm owned 36,290 shares of the company’s stock after purchasing an additional 31,028 shares during the quarter. SG Americas Securities LLC’s holdings in Beauty Health were worth $613,000 at the end of the most recent reporting period.

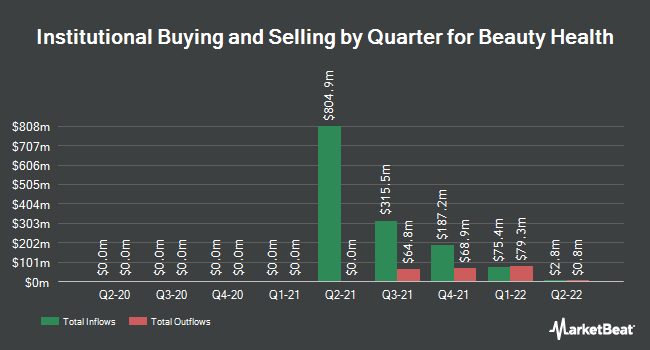

Other hedge funds and other institutional investors have also added to or reduced their stakes in the company. Nisa Investment Advisors LLC bought a new position in Beauty Health in the 4th quarter worth approximately $47,000. Zurcher Kantonalbank Zurich Cantonalbank purchased a new stake in shares of Beauty Health during the 4th quarter worth approximately $273,000. Envestnet Asset Management Inc. purchased a new stake in shares of Beauty Health during the 4th quarter worth approximately $321,000. Blair William & Co. IL purchased a new stake in shares of Beauty Health during the 4th quarter worth approximately $390,000. Finally, Handelsbanken Fonder AB purchased a new stake in shares of Beauty Health during the 4th quarter worth approximately $394,000. 72.01% of the stock is currently owned by institutional investors.

Beauty Health Stock Performance

Shares of Beauty Health stock opened at $14.29 on Thursday. The stock’s fifty day moving average is $13.08 and its two-hundred day moving average is $14.31. The company has a market capitalization of $2.14 billion, a PE ratio of -4.20 and a beta of 1.40. The company has a quick ratio of 13.57, a current ratio of 14.25 and a debt-to-equity ratio of 2.14. The Beauty Health Company has a 52 week low of $9.94 and a 52 week high of $30.17.

Beauty Health (NASDAQ:SKIN – Get Rating) last announced its quarterly earnings data on Tuesday, May 10th. The company reported ($0.06) EPS for the quarter, missing the consensus estimate of ($0.01) by ($0.05). The business had revenue of $75.40 million during the quarter, compared to the consensus estimate of $68.15 million. Beauty Health had a negative net margin of 117.84% and a negative return on equity of 0.01%. The firm’s revenue was up 58.7% on a year-over-year basis. As a group, analysts expect that The Beauty Health Company will post 0.06 earnings per share for the current year.

Wall Street Analyst Weigh In

SKIN has been the topic of several recent research reports. DA Davidson decreased their price objective on Beauty Health from $35.00 to $24.00 in a report on Wednesday, May 11th. Canaccord Genuity Group decreased their price objective on Beauty Health from $22.00 to $20.00 and set a “buy” rating on the stock in a report on Thursday, June 30th. Piper Sandler decreased their price target on Beauty Health from $24.00 to $22.00 and set an “overweight” rating on the stock in a report on Friday, July 8th. Finally, Canaccord Genuity Group decreased their price target on Beauty Health from $22.00 to $20.00 in a report on Thursday, June 30th. One analyst has rated the stock with a hold rating and nine have assigned a buy rating to the stock. According to MarketBeat.com, the company has a consensus rating of “Moderate Buy” and an average price target of $24.78.

Beauty Health Profile

(Get Rating)

The Beauty Health Company designs, develops, manufactures, markets, and sells aesthetic technologies and products worldwide. The company’s flagship product includes HydraFacial that enhance the skin to cleanse, peel, exfoliate, extract, infuse, and hydrate the skin with proprietary solutions and serums.

Read More

Want to see what other hedge funds are holding SKIN? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for The Beauty Health Company (NASDAQ:SKIN – Get Rating).

Receive News & Ratings for Beauty Health Daily – Enter your email address below to receive a concise daily summary of the latest news and analysts’ ratings for Beauty Health and related companies with MarketBeat.com’s FREE daily email newsletter.

[ad_2]

Source link