[ad_1]

Cowen downgraded shares of Sally Beauty (NYSE:SBH – Get Rating) from an outperform rating to a market perform rating in a report issued on Friday, Marketbeat Ratings reports. They currently have $17.00 price target on the specialty retailer’s stock.

Cowen downgraded shares of Sally Beauty (NYSE:SBH – Get Rating) from an outperform rating to a market perform rating in a report issued on Friday, Marketbeat Ratings reports. They currently have $17.00 price target on the specialty retailer’s stock.

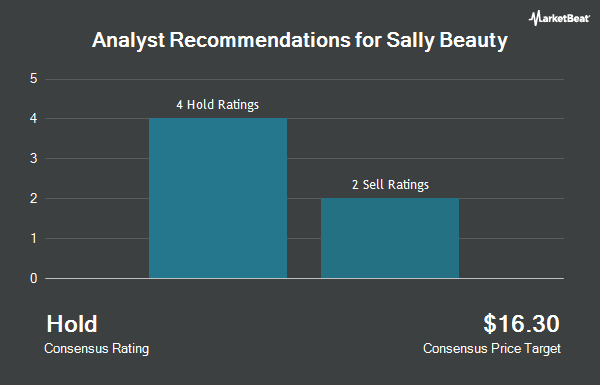

Other equities research analysts have also recently issued reports about the stock. TheStreet cut shares of Sally Beauty from a b- rating to a c+ rating in a research report on Thursday, June 23rd. Morgan Stanley dropped their target price on Sally Beauty from $12.00 to $11.00 and set an underweight rating on the stock in a research report on Monday, August 8th. Cowen downgraded Sally Beauty from an outperform rating to a market perform rating and set a $17.00 price target for the company. in a research report on Friday. DA Davidson dropped their target price on Sally Beauty from $16.00 to $14.50 and set a neutral rating on the stock in a report on Monday, August 8th. Finally, StockNews.com downgraded Sally Beauty from a buy rating to a hold rating in a report on Friday, August 5th. Two research analysts have rated the stock with a sell rating and five have issued a hold rating to the company. According to MarketBeat.com, the stock currently has a consensus rating of Hold and a consensus target price of $16.30.

Sally Beauty Stock Performance

SBH stock opened at $15.19 on Friday. Sally Beauty has a 1-year low of $11.28 and a 1-year high of $21.86. The company has a current ratio of 1.60, a quick ratio of 0.29 and a debt-to-equity ratio of 3.66. The firm has a market cap of $1.63 billion, a PE ratio of 7.45 and a beta of 1.38. The business’s 50-day moving average price is $13.16 and its two-hundred day moving average price is $15.06.

Sally Beauty (NYSE:SBH – Get Rating) last posted its earnings results on Thursday, August 4th. The specialty retailer reported $0.55 earnings per share (EPS) for the quarter, missing analysts’ consensus estimates of $0.59 by ($0.04). Sally Beauty had a return on equity of 90.85% and a net margin of 5.99%. The business had revenue of $961.47 million for the quarter, compared to the consensus estimate of $950.97 million. During the same period in the previous year, the company posted $0.68 earnings per share. Sally Beauty’s revenue for the quarter was down 6.0% compared to the same quarter last year. As a group, research analysts forecast that Sally Beauty will post 2.17 earnings per share for the current year.

Institutional Investors Weigh In On Sally Beauty

A number of large investors have recently added to or reduced their stakes in the business. Gamco Investors INC. ET AL boosted its position in Sally Beauty by 5.0% during the second quarter. Gamco Investors INC. ET AL now owns 819,180 shares of the specialty retailer’s stock worth $9,765,000 after purchasing an additional 39,130 shares during the period. Natixis acquired a new position in Sally Beauty in the 2nd quarter valued at about $155,000. EMC Capital Management raised its holdings in Sally Beauty by 51.5% in the 2nd quarter. EMC Capital Management now owns 12,424 shares of the specialty retailer’s stock valued at $148,000 after acquiring an additional 4,226 shares during the period. Edgestream Partners L.P. raised its holdings in Sally Beauty by 428.1% in the 2nd quarter. Edgestream Partners L.P. now owns 230,795 shares of the specialty retailer’s stock valued at $2,751,000 after acquiring an additional 187,089 shares during the period. Finally, Rhumbline Advisers lifted its position in Sally Beauty by 1.7% during the second quarter. Rhumbline Advisers now owns 287,351 shares of the specialty retailer’s stock worth $3,425,000 after acquiring an additional 4,928 shares during the last quarter.

About Sally Beauty

(Get Rating)

Sally Beauty Holdings, Inc operates as a specialty retailer and distributor of professional beauty supplies. The company operates through two segments, Sally Beauty Supply and Beauty Systems Group. The Sally Beauty Supply segment offers beauty products, including hair color and care products, skin and nail care products, styling tools, and other beauty products for retail customers, salons, and salon professionals.

Read More

Receive News & Ratings for Sally Beauty Daily – Enter your email address below to receive a concise daily summary of the latest news and analysts’ ratings for Sally Beauty and related companies with MarketBeat.com’s FREE daily email newsletter.

[ad_2]

Source link