[ad_1]

While many public firms enjoyed a remarkable run higher, beauty care behemoth Coty (COTY) was left on the outside looking in. Unfortunately, the COVID-19 pandemic forced millions of people to shelter in place and, in doing so, fundamentally disincentivized the broader personal care segment. Still, with normalization trends brewing – including a return to the office – beauty care could make a comeback. I am bullish on COTY stock.

Contrary to the meme-stock phenomenon that catapulted what would otherwise be considered toxically speculative investments, Coty suffered a sharp erosion of market value during the doldrums of 2020. While COTY stock did climb out of the worst of the abyss, it’s still trading conspicuously below its pre-pandemic price levels. The unfortunate catalyst comes down to a lack of incentivization for personal care.

According to the American Psychological Association, 42% of U.S. adults reported undesired weight gain, with the average gain amounting to 29 pounds. Stuck for weeks and months in a sedentary and isolating environment, it’s fair to say that COTY stock suffered from a tragic loss of relevance.

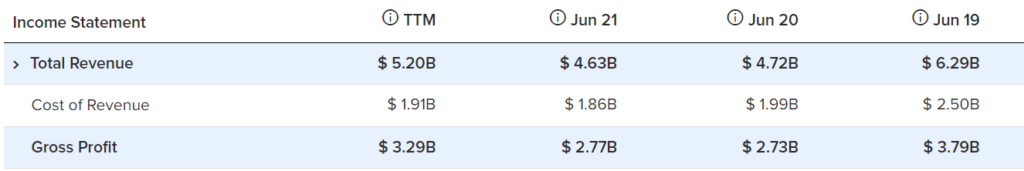

When the dust finally settled for its fiscal year ending on June 30, 2020, Coty’s revenue of $4.72 billion was down 25% from the prior year. Even worse, Coty posted sales of $4.63 billion in Fiscal Year 2021, down almost 2% over the prior year.

Still, some light may be shining at the end of the tunnel.

The Return to the Office Beckons for COTY Stock

A December 2020 op-ed from The Washington Post aptly described the new normal as the pajama moment for American workers. This year may be known as the moment when management teams have had enough and are demanding their employees return to the office. Should this narrative play out, it would spell potentially big returns for COTY stock.

First, the economy has been slowing, with the soaring inflation rate crimping consumer spending. As a result, many companies have been forced to lay off their workers, presenting an awful realization for office warriors – they’re losing the leverage they once commanded over employers during the unique dynamics undergirding the Great Resignation.

By logical deduction, it’s reasonable to expect less fuss put up by worker bees, including a take-it-or-leave-it attitude toward telecommuting privileges.

Second, the subsequent return to the office – along with other high-traffic, in-person events, and venues – should augur very well for COTY stock and investments related to enhancing outward appearances. With COVID-19 fears very much in the rearview mirror, people are expected to interact with each other physically. Thus, the incentive to look good has finally returned, and not a moment too soon for Coty.

The Evidence is in the Numbers for COTY Stock

Now, an analyst can go on and on about the bigger picture, potentially catalyzing a specific public company. However, when it comes to COTY stock, the evidence is in the numbers.

According to Coty’s latest Form 10-Q for the quarter ended March 31, 2022, net revenue came in at $1.19 billion, a 15% year-over-year increase. However, Coty’s Prestige segment at $726.4 million represented 61.2% of total sales for the quarter. In the prior-year comparison, Prestige accounted for 58.5% of total sales.

Further, for the nine months ended March 31, 2022, Prestige – which is where the company’s top-line brands, including Kylie Cosmetics, are tallied – rang up $2.6 billion in revenue or 63% of total sales. In the year-ago comparison, Prestige accounted for 60% of sales.

While it may be a small difference, it’s still significant as it may imply a consumer shift. Because the relaxing of COVID-19 restrictions is inspiring people to reengage with pre-pandemic social activities, there may be a greater incentive to look one’s best. This may be the catalyst that COTY stock has long been searching for.

Wall Street’s Take on COTY

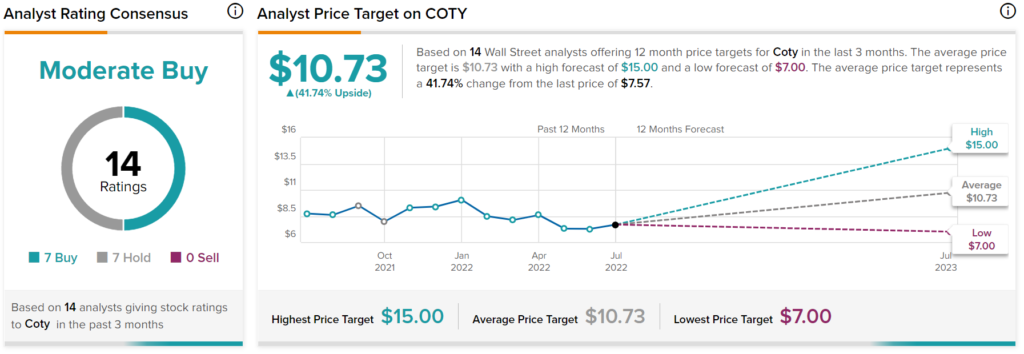

Turning to Wall Street, COTY stock has a Moderate Buy consensus rating based on seven Buys and seven Holds assigned in the past three months. The average Coty price target is $10.73, implying 41.7% upside potential.

Is COTY Stock a Buy or Sell?

While the COVID-19 crisis understandably sucked the life out of COTY stock and its ilk, the market seems to still be pricing in an environment where social interactions remain restricted. That might not be the case with a relaxing of mitigation measures causing people to reconnect with greater society. Under this burgeoning context, contrarians may want to consider adding Coty to their radar.

Disclosure

[ad_2]

Source link